For Your Information

1. CORRECTIONS AND BEARS – THE S&P 500 has had 19 “corrections” (declines of at least 10 percent but less than 20 percent) and 7 “bears” (declines of at least 20 percent) in the last 50 years. The last “correction” ended on February 8, 2018. The last “bear” ended on March 9, 2009. The S&P 500 consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index with each stock’s weight in the index proportionate to its market value. (source: BTN Research)

2. END OF THIS MONTH – The second longest economic expansion in U.S. history (based upon data tracked since 1854) will reach 9 years in length as of June 30, 2018. (Source: National Bureau of Economic Research)

3. LONG-TERM ISSUE – The estimated Social Security shortfall today (i.e., a present value number) between the future taxes anticipated being collected and the future benefits expected to be paid out over the next 75 years is $13.2 trillion. The entire $13.2 trillion deficit could be eliminated by either an immediate 2.78 percentage point increase in the combined Social Security payroll tax rate (from 12.40% to 15.15%) or an immediate 17% reduction in benefits that are paid out to current and future beneficiaries. (Source: Social Security Trustees)

4. TO AGE 90 – 25% of Americans that reach age 65 will live at least another 25 years to age 90. (Source: Social Security Administration)

5. A FEW INTO MANY – The monthly collection of jobs data in the United States is a combination of science and art. 60,000 American households are asked to complete employment surveys by the 12th of the month. The employment status of the individuals in those 60,000 households is then extrapolated to project national figures for our country’s actual 120 million households, i.e., just 1 out of every 2,000 households provided the data to calculate our country’s May 2018 jobless rate of 3.8%. (Source: Department of Labor)

6. BOTH PAY – Medicaid is jointly funded by the 50 states and the federal government. The federal government on average funds 63% of the total Medicaid expenses while the states pick up the remaining 37%. (Source: Medicaid)

This Week’s Economic News — But, First…

In addition to some generally positive economic news, there were three major events affecting the financial markets this past week. There was a historic initial summit between the U.S. and North Korea over denuclearizing the Korean peninsula; a 25 basis point rate hike by the Fed; and further threats of a trade war between China and the U.S. The three major stock indexes ended “mixed” for the week after the Dow Jones Industrials slid lower on Friday erasing its weekly gains. The Nasdaq Composite Index managed to set a new record high during the week before falling back on Friday while the S&P 500 ended minimally higher.

The stock and bond markets reacted somewhat negatively to the Federal Reserve’s monetary policy meeting on Wednesday. Fed officials decided to raise the federal funds rate by another 0.25% as widely expected, but the markets retreated after policymakers provided a more hawkish view for future rate hikes with greater expectations for a total of four rate hikes in 2018, rather than three.

Tuesday, the Labor Department reported consumer inflation in May rose 0.2% and had reached 2.8% on a year-over-year basis, its highest level since 2011. However, most of the increase in inflation is attributed to the rise in oil prices, and core inflation (excluding food and energy costs) remained close to the Fed’s target of 2%. Thursday, Retail Sales provided an upside surprise with retail sales excluding automobiles increasing 0.9% in May versus expectations for a 0.5% gain. Friday, the Trump administration declared it would follow through with an earlier warning to implement tariffs on imports of $50 billion worth of goods from China in response to intellectual property theft and forced technology transfers. China quickly responded with proposed tariffs on

$50 billion worth of U.S. goods including beef, cars, poultry, and tobacco. Hopefully, these tariff announcements are nothing more than strategizing for a negotiated solution that will avoid a full-blown trade war that would end with negative consequences for the world’s two largest economies.

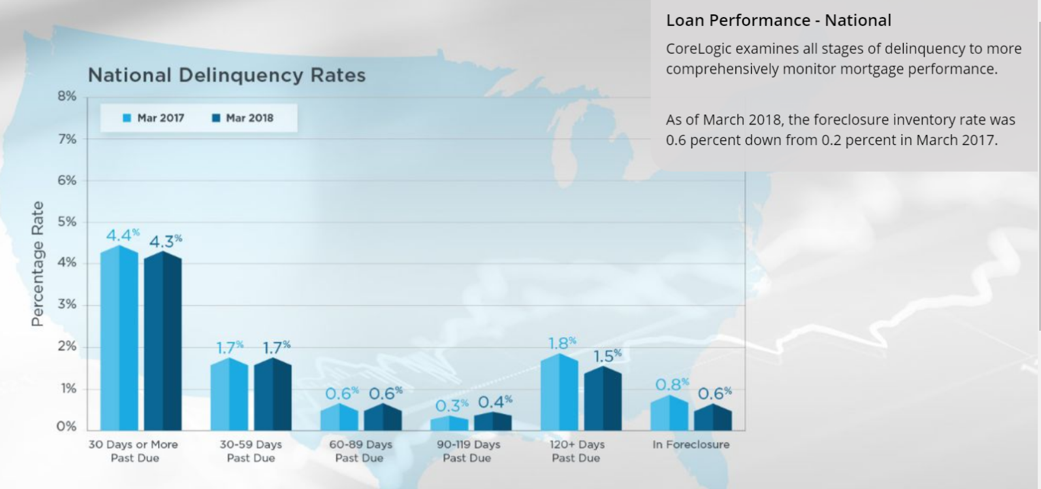

There were two mortgage-related reports released this past week. Tuesday, CoreLogic released its monthly Loan Performance Insights Report for March 2018. The report showed the number of mortgage loans 30 days or more past due declined from 4.8% to 4.3%. The serious delinquency rate, defined as those loans 90 days or more past due, dropped to 1.9% in March, the lowest delinquency rate for the month of March since 2007 when it was 1.5%. The serious delinquency rate a year ago for March was 2.1%.

The foreclosure inventory rate, a measure of the share of mortgages in some stage of the foreclosure process, was 0.6% for March – a level that has been holding since August 2017 and the lowest level since June 2007. Dr. Frank Nothaft, the chief economist for CoreLogic, remarked:

“Unemployment and lack of home equity are two factors that can lead to borrowers defaulting on their mortgages. Unemployment is at the lowest level in 18 years, and for the first quarter, the CoreLogic Equity Report revealed record levels of home equity growth with equity per owner up $16,300 on average for the year ending March 2018.” This is certainly good news for the housing industry.

Wednesday, the latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey showed a decrease in mortgage applications. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) fell 1.5% during the week ended June 8, 2018. The seasonally adjusted Purchase Index declined 2.0% from the week prior while the Refinance Index also decreased by 2.0% from a week earlier.

Overall, the refinance portion of mortgage activity remained unchanged at 35.6% of total applications from the prior week. The adjustable-rate mortgage share of activity decreased to 6.8% from 7.1% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.83% from 4.75% with points increasing to 0.53 from 0.46.

For the week, the FNMA 4.0% coupon bond gained 4.7 basis points to close at $101.641 while the 10-year Treasury yield decreased 2.6 basis points to end at 2.924%. The Dow Jones Industrial Average lost 226.05 points to close at 25,090.48. The NASDAQ Composite Index gained 100.87 points to close at 7,746.38. The S&P 500 Index added 0.63 of one point to close at 2,779.66. Year to date on a total return basis, the Dow Jones Industrial Average has gained 1.50%, the NASDAQ Composite Index has added 12.21%, and the S&P 500 Index has advanced 3.96%.

This past week, the national average 30-year mortgage rate decreased to 4.65% from 4.68%; the 15-year mortgage rate was unchanged at 4.11%; the 5/1 ARM mortgage rate increased to 3.95% from 3.94% while the FHA 30-year rate fell to 4.38% from 4.42%. Jumbo 30-year rates decreased to 4.68% from 4.70%.

Following is how the rest of the week looks like like with regards to the pertinent economic news:

Tuesday – June 19

- Housing Starts – The market expects 1,323K, prior was 1,287k.

- Building Permits – The market expects 1,343K, the previous was 1,352K.

Wednesday – June 20

- MBA Mortgage Index

- Current Account Balance – The market expects -$129.2B

- Existing Home Sales – The market expects 5.55M, the previous was 5.46M.

- Crude Oil Inventories

Thursday – June 21

- Initial Jobless Claims

- Philadelphia Fed Manufacturing Index – The market expects 27.0, prior 34.4.

- FHFA Housing Price Index

- Index of Leading Economic Indicators – The market expects 0.4%, prior 0.4%.

Mortgage Rate Forecast

The FNMA 30-year 4.0% coupon bond ($101.641, +4.7 bp) traded within a wider 53.1 basis point range between a weekly intraday high of 101.797 on Friday and a weekly intraday low of $101.266 on Wednesday before closing the week at $101.641 on Friday.

The bond fell to its secondary support level at $101.234 during the first half of the week before bouncing and moving higher just above primary short-term support at $101.586 by the end of the week. There was a new buy signal on Thursday from a slow stochastic crossover plus the bond is neither overbought nor oversold so we should see prices rise into overhead resistance levels this coming week. If the bond is able to break above overhead resistance, it should lead to stable to slightly lower mortgage rates in the coming week.

Jim’s Rate Lock Recommendation

LOCK if closing in 7 days

LOCK if closing in 15 days

LOCK if closing in 30 days

FLOAT if closing in 45 days

FLOAT if closing in 60 days