90% Loan-To-Value

2 Years from Foreclosure, Short Sale, or Bankruptcy

Interest Only Loan Available!

Up to $3,000,000 Loan Amounts

–

Simple Qualifications:

- We don’t look at withdrawals!

- We don’t look at overdrafts!

- No Profit & Loss Statement!

- No Reserves!

- No 4506T!

Personal Accounts Qualify with:

- 100% of Deposits for Personal Statements!

Business Accounts Qualify with:

- 50% of deposits for business statements!

Requirements for Personal and Business:

- 12 or 24 Months of Statement Loans Available

- Owner-occupied with 600 FICO, Non-Owner and Second Homes with 500 FICO

- Self-Employed and 1099 Borrowers Only

- Only 6 Non-Sufficient Funds in the most recent 12 months.

Disclaimer: Program guidelines are subject to change without notice.

Schedule A Call with Jim and let’s talk.

For Your Information

Some Random but Uncannily Popular Recent Questions

Few things give us more insight into human quirkiness than the kinds of questions they are most likely to answer. Here are some surprising, high-performing questions (here’s the catch, you have to answer to them to see the results):

This Week’s Economic News — But, First…

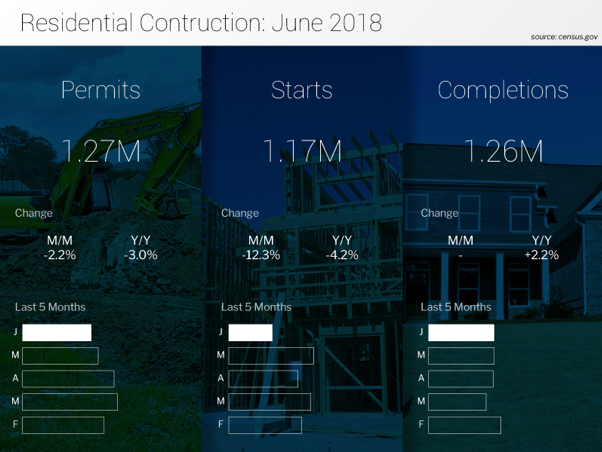

In housing, the Commerce Department reported homebuilding fell to a nine-month low during June with housing starts dropping 12.3% to a seasonally adjusted annual rate of 1.173 million units. Economists had been expecting 1.318 million starts. Single-family home building, accounting for the largest share of the housing market, fell 9.1% to a rate of 858,000 units. Meanwhile, building permits fell for the third consecutive month to a rate of 1.273 million units – a 2.2% decline to their lowest level since September 2017. The consensus forecast called for 1.301 million permits. Permits for single-family units increased a modest 0.8% to 850,000. The data from this report is somewhat surprising as it shows weakness at a time when there should be strength. This weakness reveals the difficulties builders are having finding adequate labor in addition to the challenges they are facing from higher labor, land, and materials costs.

The latest data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey released on Wednesday showed a decrease in mortgage applications. The MBA reported their overall seasonally adjusted Market Composite Index (application volume) fell 2.5% during the week ended July 13, 2018. The seasonally adjusted Purchase Index decreased 5.0% from the week prior while the Refinance Index increased by 2.0% from a week earlier.

Overall, the refinance portion of mortgage activity increased to 36.5% from 34.8% of total applications from the prior week. The adjustable-rate mortgage share of activity decreased to 6.1% from 6.3% of total applications. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.77% from 4.76% with points increasing to 0.46 from 0.43.

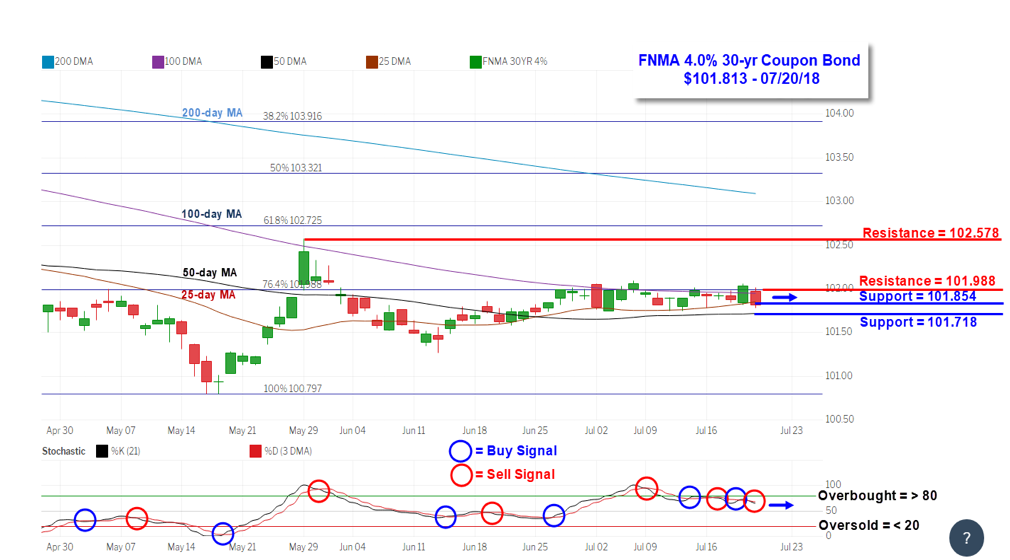

For the week, the FNMA 4.0% coupon bond lost 17.1 basis points to close at $101.813 while the 10-year Treasury yield increased 6.23 basis points to end at 2.8931%. The Dow Jones Industrial Average gained 38.71 points to close at 25,058.12. The NASDAQ Composite Index fell 5.78 points to close at 7,820.20. The S&P 500 Index added 0.52 of one point to close at 2,801.83. Year to date on a total return basis, the Dow Jones Industrial Average has gained 1.37%, the NASDAQ Composite Index has advanced 13.28%, and the S&P 500 Index has added 4.80%.

This past week, the national average 30-year mortgage rate was unchanged at 4.63%; the 15-year mortgage rate rose to 4.13% from 4.12%; the 5/1 ARM mortgage rate increased to 3.96% from 3.95% while the FHA 30-year rate rose to 4.37% from 4.35%. Jumbo 30-year rates decreased to 4.50% from 4.54%.

Following is how the rest of the week looks like like with regards to the pertinent economic news:

Tuesday – July 24

- FHFA Housing Price Index.

Wednesday – July 25

- New Home Sales – The market expects 670,000, prior: 689,000

- Crude Oil Inventories

Thursday – July 26

- Advance International Trade in Goods – The market expects -$66.7 Billion, prior: -$64.8 Billion

- Advance Wholesale Inventories

- Durable Goods Orders – The market expects 3.2%, prior: -0.6%

- Durable Goods Orders excluding transportation – The market expects 0.4$, prior: -0.3%.

- Initial Jobless Claims – The market expects 215,000, prior: 207,000

- Continuing Jobless Claims

Friday – July 27

- Advance GDP – The market expects 4.1%, prior: 2.0%.

- GDP Deflator – The market expects 2.1%, prior: 2.2%

- Final University of Michigan Consumer Sentiment Index – The market expects 97.1, prior: 97.1

Mortgage Rate Forecast

The FNMA 30-year 4.0% coupon bond ($101.813, -17.1 bp) traded within a narrow 28.2 basis point range between a weekly intraday high of 102.063 on Thursday and a weekly intraday low of $101.781 on Monday and Friday before closing the week at $101.813 on Friday. Mortgage bonds continued to trade within a narrow range between resistance and support levels ending the week between the 25-day and 50-day moving averages which serve as short-term support levels. Trading has been in a consolidating, “sideways” direction for several consecutive weeks now and it appears this “sideways” pattern could continue this coming week. Unless an unforeseen market-moving “catalyst” such as a major geopolitical or economic event comes along to shake up the financial markets this coming week, bond prices are likely to continue trading in a tight trading range resulting in relatively stable mortgage rates.

Jim’s Rate Lock Recommendation

LOCK if closing in 7 days

LOCK if closing in 15 days

LOCK if closing in 30 days

FLOAT if closing in 45 days

FLOAT if closing in 60 days