It’s been said that Texas is the last to feel an economic recession but the first to recover. While we have strong economic growth, the housing market still bears scars from our previous hard times. In 2007, the homeownership rate in Texas was 66 percent. Today, it’s 62.2 percent, the lowest level in Texas since 1997.

The good news for sellers is the demand for housing has been extremely strong and continues to rise while interest rates remain near all-time lows. But for buyers — especially first-time homebuyers — inflating home prices are clearly not a positive. Add to rising home prices the double whammy of rapidly rising rents and high student debt loads, and buying into the American Dream is fairly tough for the younger and lower-earning end of the population.

Stan Humphries, chief economist at Seattle-based real estate data site Zillow, says, “The housing market conveyer belt requires people to buy the homes. If we can’t get people on the first rung, the whole conveyer belt slows down.”

Now that we are approaching the last quarter of the year, here’s what you need to know about how the remainder of the year is likely to unfold:

Demand is still on the rise, but . . .

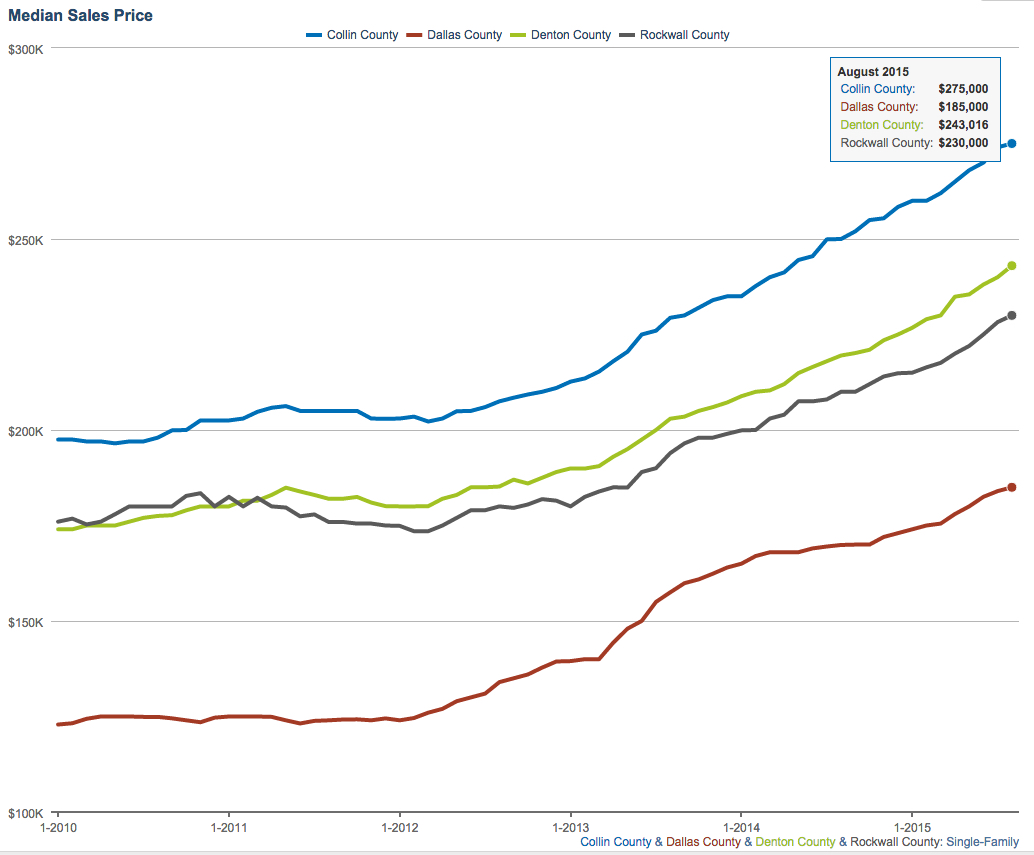

According to a study by Fitch Ratings, Texas home prices are overheated by almost 20 percent in Houston and Austin. In the Dallas-area, residential prices are 11 percent overvalued and values are 9 percent too high in Fort Worth.

The Dallas area is leading the country in home price gains — up almost by 10 percent year-over-year in March, according to CoreLogic. North Texas home prices are currently growing at about twice their long-term average rate due to a dramatic undersupply of houses on the market and strong economic growth.

Arch Mortgage Insurance Company says Texas is one of three states most at risk of a housing slowdown. They put the Dallas-Fort Worth area and San Antonio at the top of its list of cities with “moderate” risk for a softening on the housing markets.

The takeaway here is if you are considering selling it’s time to sell. If you are buying make sure you have all your ducks in a row and buy smart.

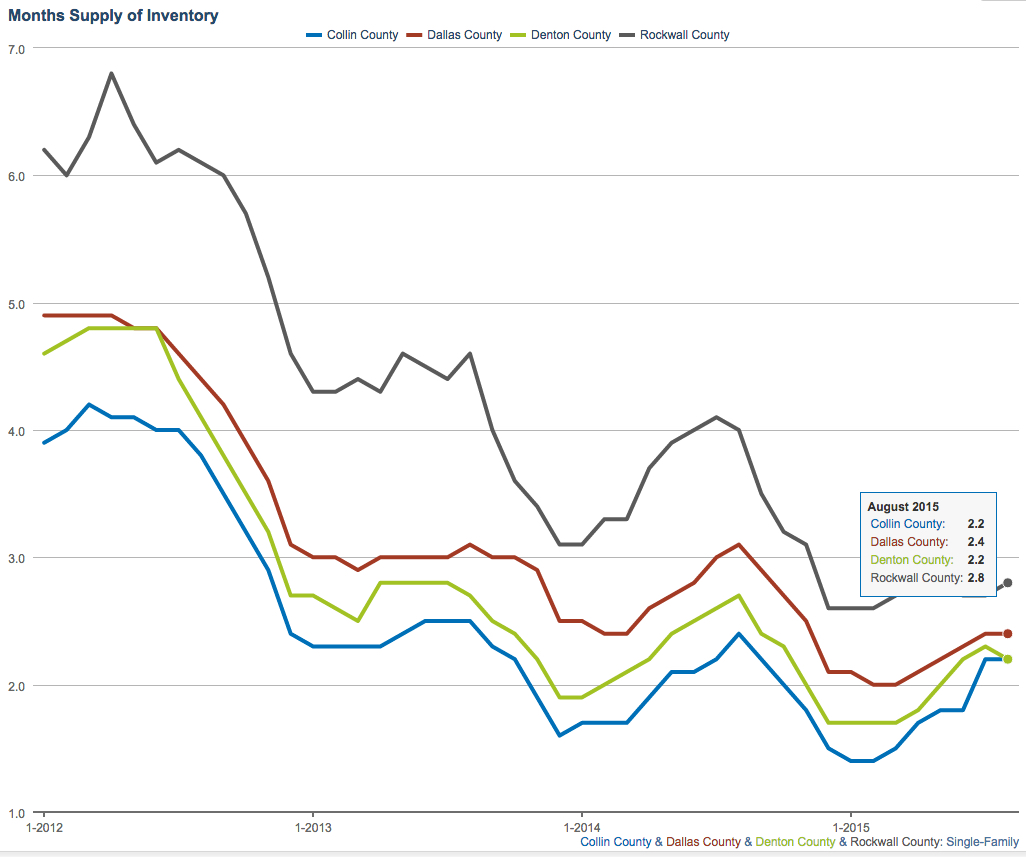

There aren’t enough homes for sale

The biggest story of 2015 by far is the lack of home inventory. This even eclipses historic low mortgage interest rates! Home supply has been on a steady decline since early 2012. Current residential home supply levels are only at 2.4 months for most areas of the Dallas-Fort Worth. This is a factor driving higher home prices. It’s all about supply and demand. Less supply, higher demand.

Better have your offer ready

The result of the factors I’ve mentioned above is that homes are moving like hotcakes. The average days on market for residential homes in the Dallas-Fort Worth area is only 12 to 20 days, per NTREIS.

My takeaway, if you are buying, employ a highly skilled real estate agent, know your bottom line and have your financing approved before you begin your home search, be ready to present your offer and be savvy in negotiating.