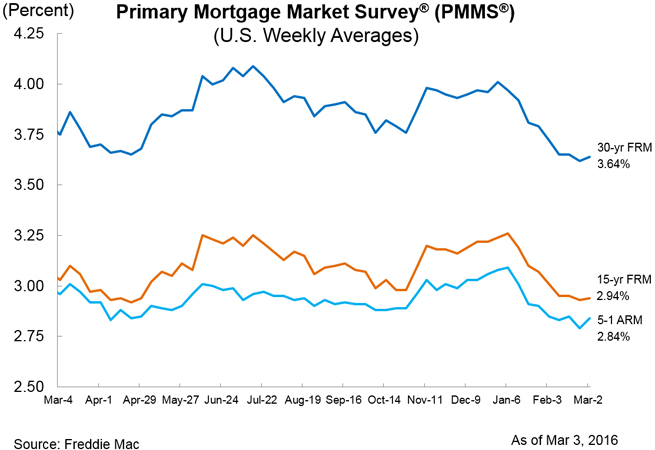

If you’ve been tracking mortgage interest rates lately, you’ve seen some volatility. Today, mortgage rates have dropped again.

In fact, mortgage rates had their largest 3-week improvement over the last 54 weeks, falling to levels not seen for many months.

What does this possibly mean for you?

If you felt like you missed the most opportune time to refinance last year, well it’s here again and it’s even better! If your current mortgage rate is 5.25% or higher and you have at least 10 years remaining on your loan, you should consider a refinance.

Today’s mortgage rates average 3.875 percent. According to Freddie Mac, homeowners have been waiting a long time before they commit to refinancing. Don’t be part of that statistic by allowing an excellent opportunity to save potentially thousands of dollars pass you by.

Should you refinance?

Let me help you answer that question. Complete the following Mortgage Plan and I will provide you an analysis of savings and tax benefits.