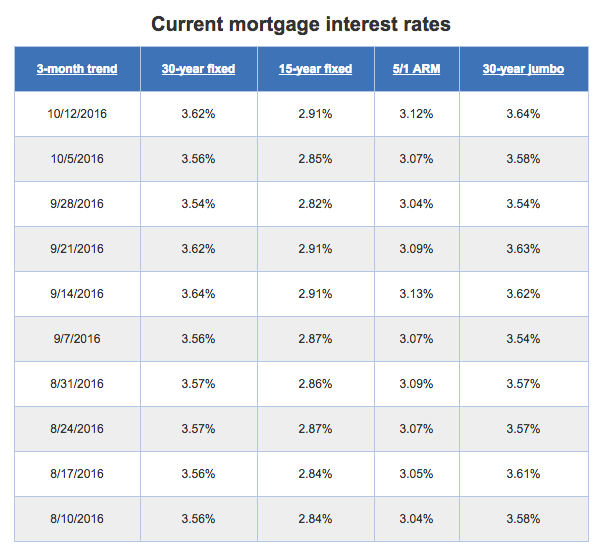

They say everything rises and falls. This certainly applies to mortgage interest rates. While we have seen interest rates at or near all-time lows for quite some time, things may be about to change.

According to Freddie Mac’s weekly survey or more than 100 mortgage lenders, conventional 30-year fixed rate mortgages increased by 5 basis points (0.05%) from a week ago. This brought nationwide mortgage interest rates trending up to 3.47 percent.

Interest rates are still incredibly low, but we may be seeing the tail end of what has been a historic run in interest rates.

The 30-year mortgage rate has been at or below 3.5 percent for 16 consecutive weeks. That is the second longest stretch in history! Mortgage rates were held below the 3.5 percent ceiling for 19 straight weeks back in late 2012 and the beginning of 2013.

The concern amongst many that we may be seeing the end to the low-interest rate streak is that there are healthy signs of an improving job market and, more people are joining the workforce.

In addition to growing job numbers is wages have increased by 2.6 percent from a year ago. This is good news for workers and their families, but investors see that this could be an imminent sign of inflation.

For now, mortgage interest rates remain low.

Freddie Mac’s weekly mortgage rate survey is vying for its 17th week below 3.5 percent, just under 3.47 percent nationwide. This is close to 40 basis points (0.40%) lower than a year ago.

So if you are wanting to capitalize on mortgage interest rates your window may be closing in, it may be time to decide.